Welcome to Durham, CT

Welcome to the official website of the Town of Durham! Our town, nestled in the heart of Middlesex County, is a tapestry of scenic beauty, historic charm, and community spirit. Durham, with its serene landscapes and deep-rooted history, offers a unique blend of tranquility and vibrancy, embodying the essence of a quintessential small town.

This website is your digital window into Durham, providing a wealth of resources, latest updates, and a peek into the aspects that make our town extraordinary. Whether you're a long-time resident or a first-time visitor, we invite you to explore, connect, and discover all that Durham has to offer.

Latest News

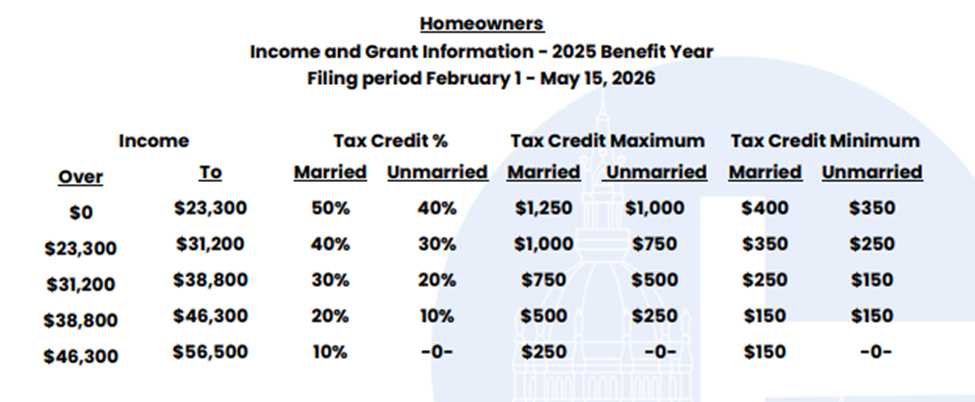

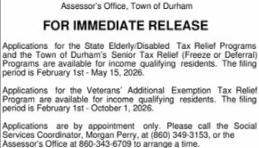

Applications are now being taken for the State Elderly/Disabled Tax Relief Programs, the Town of Durham Senior Tax Relief Programs (Freeze or Deferral), and the Additional Veterans’ Exemption Program.

The state tax relief application form is here: M-35H Owners Application.pdf

Do not complete the qualifying income portion of the application or return it to the State. It is to be completed in your appointment with the Human Services Department or the Assessor’s Office.

You must bring your filed 2025 IRS TAX RETURN (if applicable) and ALL INCOME STATEMENTS, including W-2 forms, Social Security Statements (SSA-1099), dividend and interest statements, pension statements, Veteran’s Disability Payment letters, etc. to your appointment.

For the Additional Veterans Tax Relief information and application, please click this link: Additional Veterans Tax Relief Program

January 29, 2026 Press Release, Middletown Press:

Register with Carolyn at the Community Center, 860-894-7837

Register with Carolyn at the Community Center, 860-894-7837

Upcoming Meeting & Events

We can't spell Durham without U

Durham is a town with a rich history and strong agricultural roots. This video takes you through our tight-knit community, where every resident contributes to the unique fabric of Durham. Our story is as diverse and enduring as every individual who becomes a part of it. This is your invitation to dive into the narrative that makes Durham a charming and vibrant place.